Lease Advisory

Lloyds Pharmacy Lease Restructure Achieves Sale at 6.43% yield.

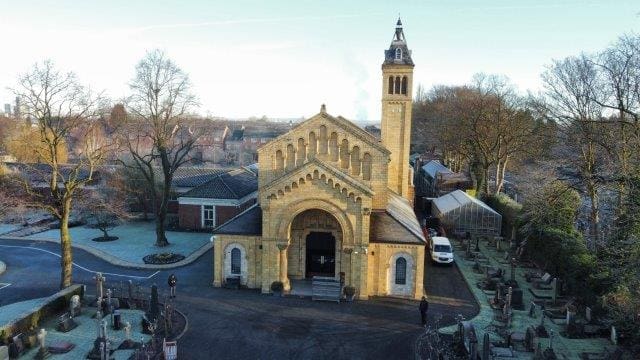

Roger Hannah were appointed to act for the owners of 236 Wellington Road South, Stockport let to Lloyds Pharmacy.

The property was let for 21 years from 1998 at £15,000 per annum with 3 years unexpired under the lease. We considered that based on this lease structure and rental that the property had a maximum market value of £195,000 reflecting a yield of 7.5%.

We advised the Landlord to seek to re-gear the lease with the tenants. Our negotiations resulted in Lloyds Pharmacy agreeing to take a new 8 year lease at a rental of £16,000 per annum rising to £18,000 per annum after year 4.

To achieve this result we had to offer the tenants a 1 year rent free period.

The effect of the new lease structure transformed the market value of the property. We marketed the investment and achieved a sale at £225,000 with the new buyers accepting that they would be responsible for the rent free period. The effective sale price amounted to £241,000 equating to a yield of 6.43%. By restructuring the lease, the clients were able to achieve a £30,000 increase in their capital value on sale.

For further information and advice, please contact our team.