£2.25m Industrial Shed

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of an Industrial Unit.

Date of Property Purchase: Pre – 2008

Purchase Price: £2.25m

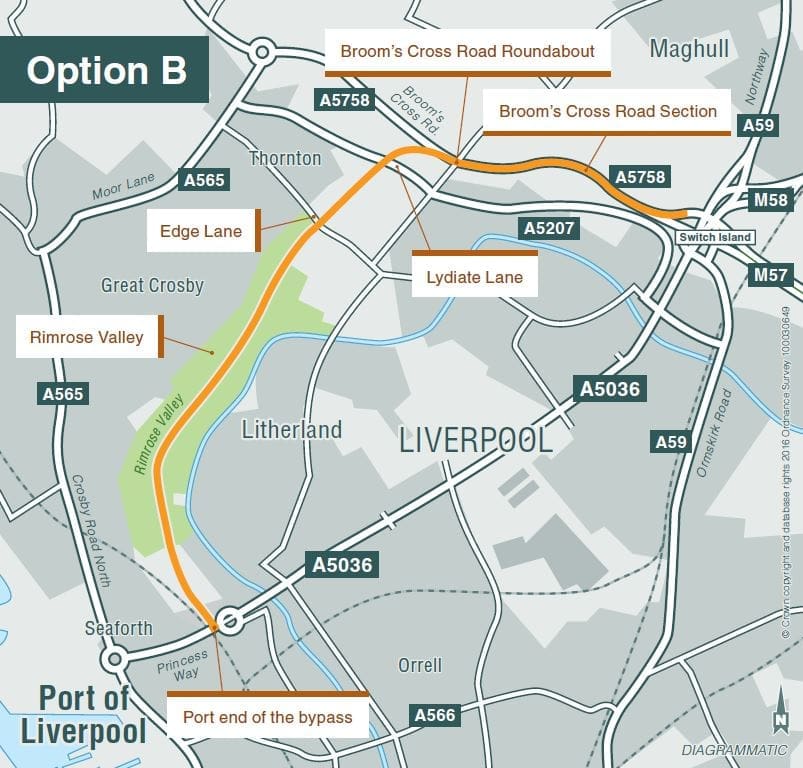

Location: North West

Capital Allowances Pool Identified: £122,519

Rate of Tax paid: 40%

Total Tax Saving: c£49,007

As shown above, our client received a total tax saving of £49,007 as a result of a claim for Capital Allowances on the initial purchase price of the property.

To understand if you or your client’s are eligible for this technical tax relief, please contact our specialist Capital Allowances team today for free consultation.