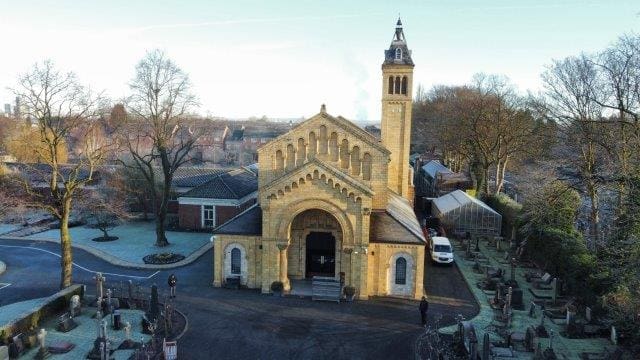

£1.6m – Special Education Needs School

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of a Special Education Needs School.

Date of Property Purchase: December 2013

Purchase Price: £1.6m

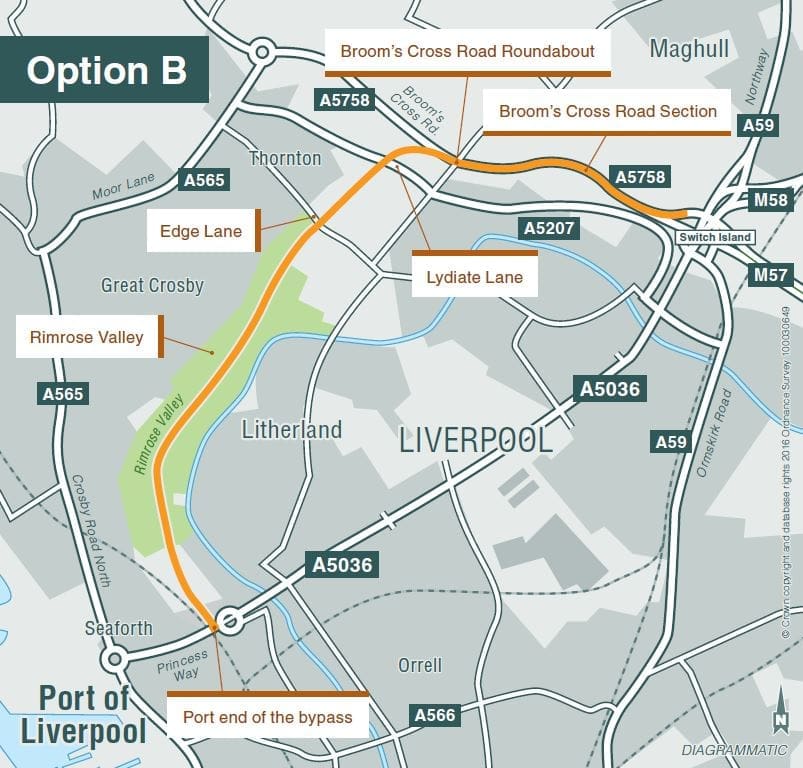

Location: North West

Capital Allowances Pool Identified: £600k

Rate of Tax paid: 20%

Total Tax Saving: c£120k

As shown above, our client received a total tax saving of £120,000 as a result of a claim for Capital Allowances on the initial purchase price of the property.

To understand if you or your client’s are eligible for this technical tax relief, please contact our specialist Capital Allowances team today for free consultation.