Capital Allowances Identified on Dental Practice

Share this article

71.2% of the Purchase Price identified as Capital Allowances.

Based on the findings of our site visit and using other historical information relating to the property, Roger Hannah valued the items of Plant & Machinery that were contained within the building at date of purchase.

- Date of Property Purchase: Nov 2013

- Purchase Price: £212k

- Location: Cheshire

- Capital Allowances Pool Identified: £151,128

As shown above, our client received a total tax saving of £151,128 as a result of a claim for Capital Allowances on the initial purchase price of the property and our due diligence findings that ensued.

Our comprehensive investigation identified a level of available capital allowances for our client amounting to 71.2% of the purchase price.

To understand if you or your client’s are eligible for this specialist form of tax relief, please contact our Capital Allowances Team today for free consultation.

Case Studies

£1,195,000 – Small Industrial Park

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of a…

Find out more

£1.6m – Special Education Needs School

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of a…

Find out more

£2.25m Industrial Shed

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of an…

Find out more

£2.7m Industrial Unit and Offices

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of an…

Find out more

£255K identified at a (historic) New Build Office Park

Our client instructed Roger Hannah to identify the level of Capital Allowances available to him on site that he built…

Find out more

£277k Industrial Unit

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of an…

Find out more

£5.3 Million Retail Property Portfolio

These brief details outline a recent case study whereby we were instructed to identify Capital Allowances on behalf of a…

Find out more

10NO. SELF-CONTAINED FLATS IN CHEADLE HULME, CHESHIRE

Roger Hannah acted on behalf of a private management company comprising of 10no. self-contained flats in Cheadle Hulme, Cheshire. We…

Find out more

15 Greek Street, Stockport Flat conversion scheme

Roger Hannah were appointed on behalf of the owner of the above property to convert an existing self-contained flat into…

Find out more

20 Greek Street, Stockport – Flat conversion change of use

Roger Hannah & Company Limited were instructed on behalf of the owner of the above property to prepare a change…

Find out more

25 Greek Street, Stockport Project coordination and contract administration.

The appointment involved inspection of the property, preparation of a schedule of dilapidations, and negotiation of the claim to settlement…

Find out more

38 Anglesey Drive, Poynton, Stockport

Roger Hannah & Co was appointed to provide Development Project Monitoring for a prestigious three storey six bedroom new build…

Find out more

38 Walton Road, East Molesey, Surrey (January 2014) Economic Viability Assessment

Instructed by the purchaser of a former retail unit and upper maisonette in East Molesey, we provided an Economic Viability…

Find out more

464 Bury Old Road, Prestwich

Our Client was served with a Planning Contravention Notice by Bury Metropolitan Council which related to three external storage containers…

Find out more

464 Palatine Road, Northenden, Manchester

Roger Hannah appointed to prepare a mutually agreeable schedule of condition for engrossment into a new commercial lease of an…

Find out more

79 Wellington Road South, Stockport – Contract Administration and CDM

Conversion of 1st floor office accommodation into 3 no. self-contained flats. Our role as Designer and Contract Administrator included: · Advising on…

Find out more

A £0.00 VALUE FOR UNECONOMIC WORKS OF REPAIR

The Upper Tribunal (Lands Chamber) has determined a property in Tunbridge Wells, which forms part of a redevelopment site, should…

Find out more

A Day in the Life of a Compulsory Purchase Surveyor

Have you ever wondered what it is like to be a Compulsory Purchase Surveyor? Compulsory Purchase is a mystery to…

Find out more

A Million Reasons why Age Matters!

Roger Hannah represented the interests of Inshade Limited, a business that trades in all forms of thermal clothing. The Company…

Find out more

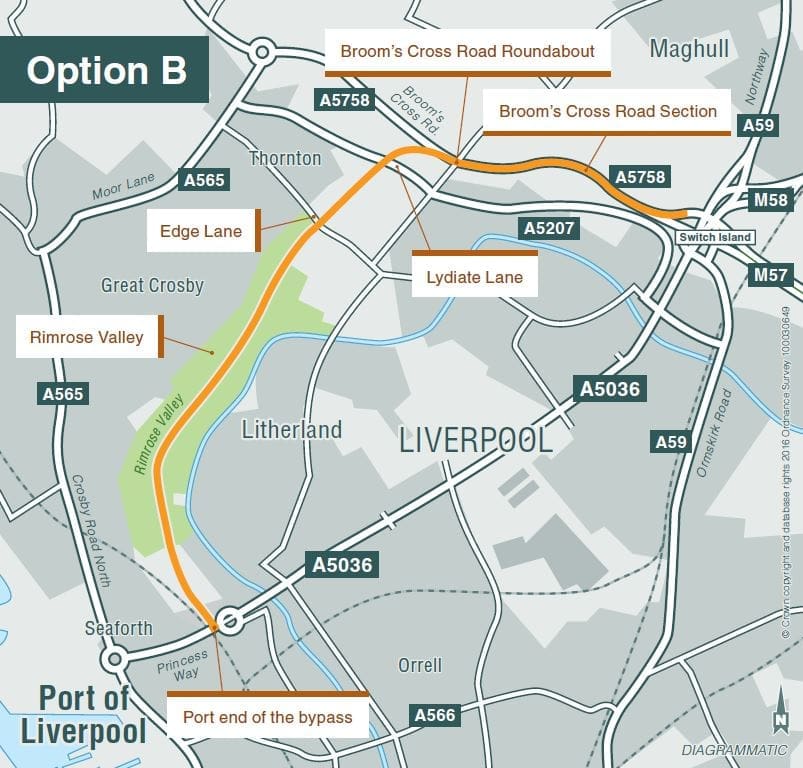

A5036 Port of Liverpool Access

The Port of Liverpool is the busiest port in the North West of England and with the new deep-sea container…

Find out more

A556 Knutsford to Bowden Improvement Scheme

Following approval granted by way of a Development Consent Order (DCO) in 2014, the new A556 link road officially opened…

Find out more

ACQUIRED Keyline, 10-20 Chorley Road, Blackpool

We have identified and acquired this trade-counter investment in the well established trade-counter destination to the North of Blackpool Town…

Find out more

Affordable Housing Reduced to Zero

Roger Hannah working in conjunction with Seddon Homes and Hourigan Connolly, have been successful in negotiating a reduction of affordable…

Find out more

Albany Trading Estate, Chorlton

Circumstances prior to our instruction. Small Trading Estate 16 units let to Local Authority and sub-let Lease to Local Authority…

Find out more

Albany Trading Estate, Chorlton – Planned preventative maintenance works (PPM).

Roger Hannah were instructed by the owners of the Estate to prepare a 5 year planned preventative maintenance programme for…

Find out more

Appointed to advise owner occupiers affected by Rainham & Beam Park development.

Roger Hannah has been appointed to provide valuation and compulsory purchase advice to a business which has premises situated in…

Find out more

AUCTION SALE ACHIEVES 22%+ MORE THAN PRIVATE TREATY SALE

Roger Hannah & Co were instructed to dispose of a 3 bed semi-detached house in Whitefield, nr Manchester. The property…

Find out more

Big Shed Big Rent Big Increase

Acting on behalf of a North West Property Investment Company, our Lease Advisory Team have recently agreed a number of…

Find out more

Birmingham City Council CPO Defeated

Acting on behalf of residential owners of No 139 Grange Road, Erdington; Roger Hannah have successfully objected to the Birmingham…

Find out more

BUILDING SURVEYS

When considering either purchasing or leasing a property, a detailed understanding of the current condition and any future maintenance and…

Find out more

Business Disturbance Claim of an Industrial Premises in Ashton Under Lyne

Roger Hannah & Co were instructed by Tameside Metropolitan Borough Council to negotiate an outstanding Business Disturbance claim made by…

Find out more

Capital & Centric – Talbot Mill, Ellesmere Street, Manchester

Capital & Centric have big plans for one of the last remaining Manchester Mills but until the development work commences…

Find out more

Chiltern Court PPM

Case Study: Chiltern Court Client Type: Property Owner / Investor Location: London Sector: Residential Project: Acting on behalf of the…

Find out more

Clear Channel Portfolio Valuation

Roger Hannah and Co have recently completed a valuation of Clear Channel UK Limited’s portfolio of freehold and leasehold stock comprising…

Find out more

Cobcroft Medical Centre, Huddersfield

Roger Hannah & Co was appointed on behalf of… A Leading Healthcare Provider Cobcroft Medical Centre, Huddersfield Following on from…

Find out more

Cold Food = Hot Property

Roger Hannah & Co scores success in the South Yorkshire Warehouse and Distribution Sector: Acting on behalf of a Private…

Find out more

Completed CPO Negotiations at Medway Walk, Miles Platting, Manchester.

Roger Hannah has recently completed negotiations on behalf of a number of property owners affected by the long running Miles…

Find out more

Compulsory Acquisition of an Asset of Community Value (ACV)

Roger Hannah has recently advised South Cambridgeshire District Council on a property held as an Asset of Community Value (ACV)…

Find out more

CONDITION IMPROVEMENT FUND (CIF)

What is the Condition Improvement Fund (CIF) Process? The Condition Improvement Fund (CIF) is an annual bidding round for eligible…

Find out more

Crumpsall & Cheetham Hill Library Sold for over £500,000

This prominent grade II listed landmark building was sold in the February Auction, on behalf of private owners to a…

Find out more

Defective Construction Works and Property Valuation

Simon Cook of Roger Hannah & Co was asked to act as an expert for insurers representing a major construction…

Find out more

Dilapidations settlement successfully negotiated for Audio T

Roger Hannah & Co were appointed by Audio T in September 2012 to defend a Terminal Dilapidations claim in excess…

Find out more

Dilapidations-acting for Tenant

Roger Hannah & Co was appointed by Clear Channel UK Limited to act on their behalf and to defend a…

Find out more

Dinting, Glossop Site Achieves Planning with Zero Affordable Housing

Roger Hannah & Co, acting on behalf of a developer client, has been successful in negotiating a zero affordable housing…

Find out more

Ellard House, Floats Road, Roundthorne Industrial Estate

Project Description Ellard House, Floats Road, Roundthorne Industrial Estate Further to a previous role acting as Employers Agent and Client…

Find out more

Employers Agent Case Study – April 2013

Roger Hannah & Co Instructing on behalf of Marnshaw Limited, Roger Harrison CEO of Ensor Holdings Plc instructed Roger Hannah…

Find out more

Employment Land Release Success in Hyde

Roger Hannah & Co have been successful in preparing an employment land release and viability report of Newton Business Park…

Find out more

Ergon House, Business Rates Assessment Reduction

Acting on behalf of Liquidators of the former tenant, Roger Hannah & Co have agreed a significant reduction in the…

Find out more

Eric Moore Medical Centre, Warrington

Project description Eric Moore Medical Centre, Warrington Following our involvement in the construction of a new build medical centre in…

Find out more

Eric Moore Partnership Medical Practice

On Friday 16th September 2016 – Neil O’Brien (Director of Building Consultancy) and Steven Whittle (Building Surveyor) Roger Hannah &…

Find out more

Excelsior Mill Sold to Mulbury Homes

Acting on behalf of the Site Owner Roger Hannah is delighted to have sold Excelsior Mill to Mulbury City. The…

Find out more

Expert Witness Report for Salford Land Negligence Dispute

Simon Cook of Roger Hannah & Co was appointed to act as a Single Joint Expert by two practices of…

Find out more

Expert Witness Under Part 35 of the Civil Procedure Rules Over the Disposal of a Multi-let Residential Building

Simon Cook of Roger Hannah & Co was appointed to act as an Expert Witness under Part 35 of the…

Find out more

Expert Witness under the Civil Procedure Rules For Acquisition of a Multi-million Pound Retail Centre

Simon Cook of Roger Hannah & Co was appointed to act as an Expert Witness under the Civil Procedure Rules…

Find out more

Factory Premises, Oldham

This property was recently purchased by a client and we appealed against rateable value on the grounds of a material…

Find out more

For Residential Developers

Unlock development value from your land assets by ensuring you obtain the highest quality of advice. Our transactional and advisory…

Find out more

Former Casino & Nightclub, Southport

The property had been vandalised and was suffering from subsidence/structural defects and had been acquired by a developer. We appealed…

Find out more

Former Industrial Site, Greater Manchester

Working with our client we devised an empty rates mitigation strategy involving temporary occupation of the property resulting in savings…

Find out more

Gorsey Mount Street, Stockport

Roger Hannah & Co was instructed by Pennine Properties Limited to project manage the construction of circa 10,000sq.ft of new…

Find out more

Greater Manchester Police Station

Acting on behalf of a developer client who acquired the premises as a residential development site, we successfully appealed the…

Find out more

Hammerson’s Victoria Gate Retail Development

Roger Hannah & Co were appointed to represent ATC Properties who owned the long leasehold interest in No 7 –…

Find out more

Hams Hall Distribution Park, Birmingham – Schedule of Condition

Roger Hannah has recently prepared a schedule of condition for our client who was the ingoing tenant at the above…

Find out more

Hempshaw Industrial Estate, Stockport – Repair and Refurbishment works

Roger Hannah & Company Limited were appointed by the owners of Hempshaw Industrial Estate to general repairs and refurbishment works at…

Find out more

HIGH SPEED TWO & STATUTORY BLIGHT NOTICE

Roger Hannah successfully negotiated the disposal of Wheatley House in Marston, Warwickshire to High Speed 2 Limited following the serving…

Find out more

High Street Shop, Didsbury

Acting for the landlords in a lease renewal, we successfully negotiated a 25% increase in the rent whilst securing a…

Find out more

High Street Shop, Shrewsbury

Acting for the landlord and faced with tenant’s refusal to accept the landlord’s right to implement an outstanding rent review…

Find out more

Hilton House, Lord Street, Stockport

Roger Hannah was instructed by the landlord of the above property to implement refurbishment works to the property which included…

Find out more

Houldsworth Mill Birthday Present

Roger Hannah & Company are pleased to report the introduction of a new use to their longstanding flagship regeneration property…

Find out more

Houldsworth Mill, Reddish, Stockport

Before Grade II * Listed building full Low levels of maintenance Poor covenant low grade occupational tenancies Low service charge…

Find out more

HS2 Case Studies

HS2 is currently in the early stages of the CPO process and as such our involvement with the project is…

Find out more

HS2 REVISED PROPOSALS TO DEVELOP THROUGH SHIMMER HOUSING ESTATE

In November 2016, HS2 Limited announced the safeguarding of land required for the delivery of the route of Phase 2B…

Find out more

HS2 Update: Phase 2B

Since the route of Phase 2B was announced in November 2016, our specialist team at Roger Hannah has been acting…

Find out more

Industrial Unit, Trafford Park

Acting for a tenant of an industrial unit whose landlord had served them with a Section 25 Notice terminating their…

Find out more

Lakeside, Cheshire

A modern office block located in a business park location undergoing substantial structural alteration and repair. The rateable value of…

Find out more

Large Industrial complex, Cheshire

On the grounds that the property was incapable of beneficial occupation, we successfully appealed the assessment reducing the Rateable Value…

Find out more

Leigh Medical Centre, Wigan Employers Agent

Roger Hannah & Company Limited were recently involved in the construction new build medical centre in Leigh. Contract value circa…

Find out more

Liverpool One Redevelopment

Roger Hannah represented Clear Channel UK Limited who were affected by Grosvenor’s plans to redevelop Liverpool City Centre in a…

Find out more

Liverpool Paradise Street Redevelopment

Roger Hannah represented Clear Channel UK Limited who owned part of the land that now forms part of the John…

Find out more

Lloyds Pharmacy Lease Restructure Achieves Sale at 6.43% yield.

Roger Hannah were appointed to act for the owners of 236 Wellington Road South, Stockport let to Lloyds Pharmacy. The…

Find out more

Local Shopping Precinct in Warrington

Acting on behalf of a London based property Investment Company Roger Hannah & Co.’s Landlord and Tenant department have between…

Find out more

London Crossrail

Acting for Kroll Ontrack, Roger Hannah & Co, negotiated for the company to leave their 10,000 sq ft of office…

Find out more

London Olympics

Roger Hannah & Co represented Clear Channel UK Limited, the outdoor media company. They leased 6 advertising sites across East…

Find out more

LOSS OF PROFITS – DO NOT GIVE UP!

Roger Hannah represented the interests of Ceramic Tiles Limited one of the leading regional tile importers. Ceramic Tiles Limited is…

Find out more

Manchester Airport 2nd Runway

Acting for Manchester Airport plc and Manchester City Council, Simon Cook, was responsible for the acquisition of all land and…

Find out more

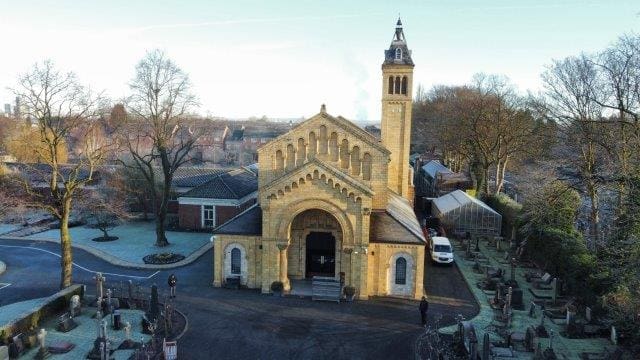

Manchester Crematorium PPM

Case Study: Manchester Crematorium PPM Client Type: Property Owner / Investor Location: Manchester Sector: Commercial Project: Roger Hannah’s Building Consultancy…

Find out more

Manchester High School for Girls (MHSG)

Case Study: Manchester High School for Girls (MHSG) PPM Client Type: Private School / Education Provider Location: Manchester Sector: Education…

Find out more

Markazi Jamia Mosque, Ashton under Lyne

Roger Hannah acted on behalf of a local Ashton Mosque in their compensation claim resulting from the Ashton Town Centre…

Find out more

Mayfield Redevelopment Project – Manchester

Roger Hannah & Co has recently represented an investment owner of premises adjacent to the A57(M) Mancunian Way within Manchester…

Find out more

Mersey Gateway Claim Settled

Roger Hannah & Co was appointed by Gussion Transport Limited to represent their interests in the Mersey Gateway CPO for…

Find out more

Mersey Gateway Compulsory Purchase

As a practice Roger Hannah & Co represent 3 significant land owners and local business’ affected by the Mersey Gateway…

Find out more

Modern Office Investment – Manchester

An uncomplicated capital allowances claim on a self-contained modern office building in Manchester held as an investment by the client…

Find out more

Modern Office Portfolio – Kent

Owned as an investment, we were engaged to undertake a capital allowances excercise on two modern office buildings in Kent…

Find out more

More Business Rates Appeal Success for Roger Hannah

Roger Hannah’s Rating department has been busy over recent months in what looks likely to be a record year of…

Find out more

More Employment Land Release Success

Roger Hannah have been successful in releasing land from employment use at the former Briars Lane Industrial Estate in Burscough…

Find out more

Multi-million pound deal completed at Paddington Basin, London

Roger Hannah & Co has successfully negotiated compensation for the final long leasehold interests of residential flats in Dudley House…

Find out more

Nashe Drive, Stoke-on-Trent – Repair and Refurbishment Works

Roger Hannah & Company Limited are Managing Agents of the above property which comprises a series of ground floor retail…

Find out more

New Development Presses Forward at West Hendon

The redevelopment of the West Hendon Estate has been marred with opposition from the beginning however building work is now…

Find out more

No more of a Mill Stone hanging round the developer’s neck

Acting on behalf of the owners of a large derelict mill building in Manchester, Roger Hannah & Co has successfully…

Find out more

Northamptonshire Residential Site Achieves Planning

Northamptonshire Residential Site Achieves Planning Roger Hannah & Co has been successful in guiding a development opportunity through planning to…

Find out more

Office Building, Salford

We appealed the 2010 rating assessment on the grounds that the rateable value was excessive and successfully achieved a reduction…

Find out more

Overseeing the design and fit out of a purpose built conversion within a Grade II listed building

Project Description SG2 Houldsworth Mill, Reddish, Stockport Roger Hannah and Co were appointed jointly on behalf of the Owners and…

Find out more

Plymouth – 36% Rates Reduction for Sea Front Restaurant.

Acting for the occupier of a sea front restaurant and bar located on Plymouth Hoe we have successfully negotiated a…

Find out more

Public Space Contributions Removed to Bring Forward Scheme

Roger Hannah have recently been involved in ensuring that an Affordable Housing and Extra Care Scheme achieves planning in West…

Find out more

Rainford Industrial Estate, St Helens Planning Permission application

Roger Hannah & Company Limited were appointed on behalf of the owners of Rainford Industrial Estate to obtain planning consent…

Find out more

Rates Reduction at Cafe Bar Media City Manchester

A modern cafe and bar situated in Salford Quays acting on behalf of the operator we successfully negotiated a reduction…

Find out more

Refurbishment of 50,000 sq.ft office at Lakeside, Cheadle

Lakeside House, Lakeside, Cheadle Royal Business Park, Cheadle Roger Hannah & Co Structurally glazed double height extension to reception. Refurbishment…

Find out more

Refurbishment of Chatham Street Spiritualist Union Church

Roger Hannah & Co were appointed to provide advice in relation to the extension and comprehenisve refurbishment of Chatham Street…

Find out more

Retail Parade – Stockport

Our initial involvement with this case was in a commercial agency capacity with a number of lettings having taken place…

Find out more

Right and Wrong Valuations

Roger Hannah represented the interests of the owners of the listed Market Hall Building, Holyhead, Anglesey. The building dated from…

Find out more

Roger Hannah & Co appointed on behalf of leading firm of Solicitors

Project Description Dilapidation Assessments – Property portfolio Roger Hannah & Co has been appointed on behalf of a leading firm…

Find out more

Roger Hannah & Co was appointed on behalf of A global textile importer

Project Description Globe Industrial Estate Roger Hannah & Co were appointed to defend a possible Terminal Dilapidations claim against and…

Find out more

Roger Hannah & Co was appointed on behalf of An International Investment Company

Project Description 39 St Vincent Place, Glasgow Roger Hannah & Co appointed to prepare a Pre-Acquisition Building Condition Report on…

Find out more

Roger Hannah & Co was appointed on behalf of Law Library

Project Description Law Library, Manchester. Roger Hannah & Co appointed by an International Investor to provide a Building Condition Report…

Find out more

Roger Hannah & Co was appointed on behalf of Leading North West Property Investor

Project Description Blackmoor Road, Guide, Blackburn Roger Hannah & Co appointed to prepare a mutually agreeable Schedule of Condition, for…

Find out more

Roger Hannah Calls Time in Greenwich

Earlier this year, Roger Hannah concluded negotiations on behalf of two remaining leaseholders within the Morris Walk Estate in Greenwich…

Find out more

Roger Hannah complete quintuple of negotiations

Roger Hannah recently completed their fifth set of negotiations against HS2 Limited within the village of Water Orton. Instructed by…

Find out more

S FRANSES V THE CAVENDISH HOTEL (LONDON) LTD

Landlords grounds refusing a new tenancy Under s.30 (1) (f) Redevelopment: A recent judgement handed down in the Supreme Court…

Find out more

Salford Central Regeneration

Roger Hannah has represented a number of land owners who have been affected by Salford Central Regeneration Project. The development…

Find out more

School Successful in CIF Application

An Academy, had suffered with dampness within certain areas of the school due directly to the poor condition of their…

Find out more

SEMMMS CPO of Moorend Golf Course

Roger Hannah & Co have acted on behalf of the owners of Moorend Golf Course in Woodford, Stockport. Their occupation…

Find out more

Significant Rates Reduction at Car Showroom in Grantham

Acting on behalf of the owner of a car showroom in Grantham, Lincolnshire we successfully reduced the empty rate liability…

Find out more

Significant Rates Reduction for an Apart Hotel in Liverpool

A period property located in the heart of Liverpool City Centre, acting on behalf of the developer we successfully reduced…

Find out more

SOLD 53 Kingsway South, Warrington

We have disposed of this multi-let prominent roadside mixed-use scheme anchored by Subway in conjunction with CBRE and on behalf…

Find out more

Special Educational Needs Schools (SENS) – Capital Allowances

In conjunction with our partners, leading accountants BDO LLP, we have carried out numerous capital allowances claims on SENS across…

Find out more

Station Approach, Grantham – Successfully Opposing a CPO

Roger Hannah were appointed by Tanvic Group Ltd to represent their interests in respect to their freehold site affected by…

Find out more

Stockport Town Centre Regeneration

Roger Hannah is currently advising Stockport Metropolitan Borough Council on various regeneration and improvement projects being delivered across the Town…

Find out more

Sub-Station Roof Repairs

HISTORY Houldsworth Mill was designed by Abraham Stott, for wealthy mill owner Henry Houldsworth and constructed in 1865. The building…

Find out more

The Benefits of a Schedule of Condition

A Schedule of Condition provides a factual record of the current condition of a property, structure or land and is…

Find out more

The Role of Mediation

In 2015 Roger Hannah was appointed by Prestige Motors Direct Limited to represent their interest in respect to a CPO…

Find out more

The Shambles Square Shopping Centre, Market Street, Manchester

Roger Hannah were appointed by Manchester City Council to represent their interests in negotiating compulsory purchase order claims by retailers…

Find out more

Toxteth Street Compulsory Purchase Order

Roger Hannah and Co acted for Adactus Housing Association in negotiations against Manchester City Council in the Toxteth Street Compulsory Purchase Order. …

Find out more

Trade Counter Success for Manchester

Acting on behalf of a Private Property Investment Company and owners of a number of trade counter units, the Landlord…

Find out more

UK Hearing Care – 103 Dalton Avenue, Birchwood Park

In advance of a move to new premises at 103 Dalton Avenue, UK Hearing Care contacted Roger Hannah, to discuss…

Find out more

Unit 8 Stadium Way Industrial Estate, Reading

Roger Hannah & Co was appointed by Plasman Laminates Limited to act on their behalf and to defend a Terminal…

Find out more

Unit D, Poynton Industrial Estate – Acquisition Survey of 1960’s constructed industrial unit circa 13,724 sq ft

Our advice included commentary on: general state and condition of the property. wants of repair including remedial works required and…

Find out more

Van Parts, Manchester

A company specialising in the sale of second hand van parts owned a 20,000 sq ft mill style industrial premises…

Find out more

Waterloo Works, Stockport – Project Coordination and Contract Administration

Roger Hannah Ltd were appointed on behalf of the owner of the above property to organise repairs and refurbishment of…

Find out more

Westlink Industrial Estate, Leigh

A modern single storey industrial estate in prominent position fronting East Lancs Road where we appealed against the rateable value…

Find out more

What a difference a year makes

When Roger Hannah were appointed as managing agents of an industrial estate in Aintree it soon became apparent that relations…

Find out more

What is an EPC?

An EPC (Energy Performance Certificate) is a guide to a building’s energy efficiency. The rating system rates a building on…

Find out more

Wheel Forge Way, Trafford Park

Acting on behalf of a national online clothing retailer Roger Hannah & Co were successful in agreeing a substantial reduction…

Find out more

Working with Charities

We understand that Charitable organisations can be faced with challenges when trying to deal with property issues. At Roger Hannah…

Find out more