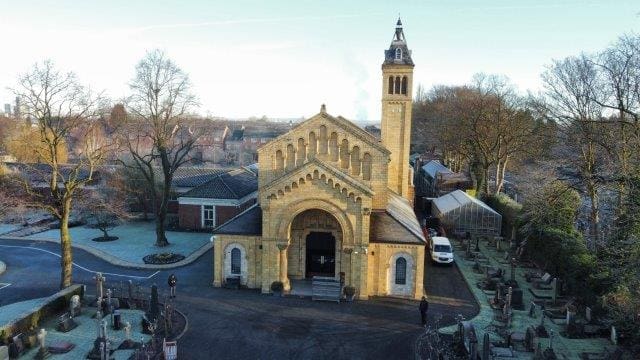

£255K identified at a (historic) New Build Office Park

Our client instructed Roger Hannah to identify the level of Capital Allowances available to him on site that he built Pre 2008 and still owns as a trading asset today.

Based on the findings of our site visit and using additional information obtained relating to the build of the site, Roger Hannah were able to comprehensively value the site build and the individual items of qualifying Plant & Machinery, at the time of the historical build completion date.

Summary of Capital Allowances claim is as follows:

- Date of Build: March 2006 – Nov 2007

- Construction Cost: £1.3M

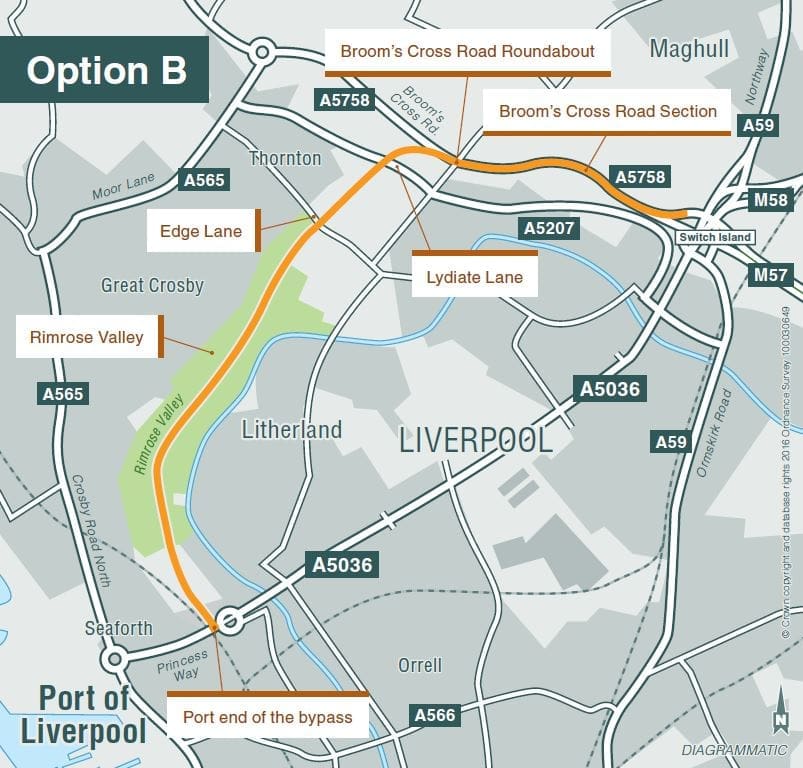

- Location: Leicester

- Capital Allowances Pool Identified: £255,507

As a result of our investigation on the initial build of the site, our due diligence findings that ensued and the report made from our site visit, as shown above, our client received a total tax saving of £255,507 (Capital Allowances Pool).

Although this build was undertaken prior to the extra Capital Allowances made available through the change in Government Legislation post 2008, our comprehensive investigation identified a level of available Capital Allowances for our client amounting to 19.7% of the build price.

To understand if your existing Commercial Property Portfolio qualifies for Capital Allowances, contact the specialist team at Roger Hannah today for a free no obligation consultation.