Business Rates

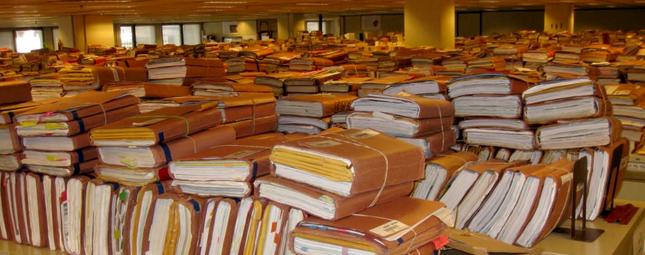

This could take years as Rates Appeals backlog mounts.

How long have you got?

Businesses that appeal their 2017 rates assessment could be in for a shock and have to wait years for them to be resolved because of a backlog facing the Valuation Office Agency (VOA) from outstanding appeals and Government proposals to alter the appeals system.

There are currently around 280,000 appeals outstanding against 2010 assessments and only 64,000 appeals were dealt with last year, at this rate it could take over 3 years just to clear the backlog before any 2017 appeals are even considered.

The Government is facing calls to overhaul the way business rates are dealt with, but with the VOA being forced to slash a third of its resources by 2020 the whole system is grinding to a halt leading to many business groups and property professionals questioning whether this property tax which traces its ancient roots back to the 1572 Poor Law is fit for purpose in the 21st Century.

With reforms to the appeals process being introduced by the Government in an attempt to streamline and make it easier for businesses to appeal their rates in what is being termed “check, challenge and appeal” it is incomprehensible that the VOA is not being properly supported or resourced to deal with the current backlog and manage the 2017 list. Of note is that this “Check Challenge Appeal” system has already been scrapped by the Welsh assembly who view this as an English only matter.

It looks like many businesses should be prepared for a long haul if they are relying on a successful rates appeal to reduce their property tax burden. And even then Government proposes to limit the grounds for a reduction in any successful appeal to no more than those outside the bounds of reasonable judgement, which broadly means even if your rates are over assessed anywhere between 10-15% there will be no reduced bill.

As the row rumbles on, uncertainty reins. The Government needs listen to the views of business and take urgent action to reduce excessive rates, implement more frequent revaluations and a fair appeals system.